Title: Illuminating Nigeria: Blurring the Lines Between the Grid and Off-Grid Electricity

Africa’s most populous country, Nigeria, faces significant challenges in its power sector, including frequent power cuts, poor power quality, and limited electricity access in rural areas. To address these issues, researchers have proposed both centralized, grid-based and decentralized, off-grid solutions. While development programs typically focus on one kind of solution over the other, we argue that the distinction between on-grid and off-grid solutions should not be as rigid as traditionally perceived. Given the unique condition of Nigeria’s power system, coupled with recent legislation, an electrification strategy that harnesses the synergies and complementarities between on-grid and off-grid solutions offers short-term and long-term advantages in the mission to achieve universal access to reliable and affordable electricity.

With less than six years to the target date of the United Nations’ Seventh Sustainable Development Goal, which focuses on achieving universal access to clean energy, over 86 million people remain without access to electricity in Nigeria—the highest number globally. In rural areas, less than a third of residents have electricity access. While urban areas fare far better with an access rate of 89 percent, significant gaps between electricity demand and supply, as well as aging infrastructure, cause frequent power outages and substandard power quality. For instance, the Nigeria Electricity System Operator recently reported a forecasted daily peak demand of 20 GW against an installed generation capacity of 13 GW, yet the all-time highest generation is merely 5.8 GW. Despite being one of the continent’s largest economies, Nigeria’s national grid generally lags behind other African countries in electricity reliability.

The power challenges confronting Nigeria have ultimately undermined its development and growth. Reliable electricity access is a major constraint for businesses in Nigeria, which, combined with a weakening currency, has led several leading companies to relocate their operations to neighboring countries with more reliable electricity supply and better macroeconomic conditions. Moreover, households and businesses often compensate for unstable power supply by adopting off-grid solutions, such as standalone fossil fuel-powered generators and solar photovoltaic systems. Approximately 84 percent of urban households and 86 percent of companies use backup power supply systems in Nigeria, primarily based on fossil fuels.

The financial toll of these electricity shortages is profound, with economic losses reaching up to $26 billion annually, not accounting for the environmental and health externalities associated with fossil fuel combustion from backup generators. Additionally, the Energy Commission of Nigeria estimates that around $22 billion is spent annually fueling the millions of off-grid generators operating across the country, with a combined capacity of about 40 GW. Furthermore, recent fuel price increases and the falling naira may make renewables more viable than traditional backup generators. This raises a critical question: can new and existing off-grid systems, particularly renewable energy sources, complement the existing grid infrastructure to reduce costs and enhance the reliability and availability of electricity in Nigeria?

Evolving Regulatory and Policy Environment

The challenges discussed above highlight the need for power sector reforms. Past reforms have sought to address key challenges facing the sector such as mobilizing capital to develop new generation stations, upgrading transmission and distribution networks, and improving revenue collection through the installation of electric meters. In 2005, the Nigerian government enacted the Electric Power Sector Reform Act (EPSRA) to unbundle the national utility into generation (GenCos), transmission, and distribution companies (DisCos). The EPSRA moved GenCos and DisCos toward privatization to attract private sector investment.

Despite these reforms, many of the challenges plaguing the system persist, leading to calls for further reforms such as the recently signed Electricity Act of 2023. This legislation seeks to empower states with greater autonomy, including the ability to establish independent electricity markets and further decentralize and privatize the power sector. It also gives licenses to minigrids, which are small power systems that supply electricity to distribution networks, typically serving small communities in rural areas. These initiatives aim to increase foreign investment in Nigeria’s power sector.

However, regulatory barriers to charging cost-reflective tariffs that align with the true cost of providing electricity to consumers have frustrated private actors and impeded the success of these reforms. The Multi-Year Tariff Order (MTYO), introduced in 2008, sought to replace fixed tariffs with periodically adjusted ones based on macroeconomic indices and fuel costs. Though government subsidies traditionally offset portions of these tariffs, they have become unsustainable. Electricity subsidies will cost around N2 trillion in 2024, far exceeding the N450 billion allocated by the government. As a consequence, the government may currently owe as much as N1.3 trillion to GenCos. The recent currency depreciation has also worsened the financial strain on GenCos, impacting the costs of spare parts, fuel, and loan servicing that rely on foreign currencies.

Recently, the government decided to cut electricity subsidies for the top-consuming 15 percent of consumers, who use about 40 percent of the nation’s electricity, increasing their tariff by over 300 percent. While this move will reduce the subsidy burden, it may also encourage the almost two million consumers impacted by this change to switch to off-grid solutions, reducing revenues for the DisCos. Other potential repercussions of this policy change include an uptick in electricity theft and a decrease in electricity consumption. In 2023, a similar removal of petrol subsidies led to the price of petrol tripling within a single month, resulting in strikes organized by the Nigeria Labour Congress. Given the widespread reliance on fossil-fuel-powered generators, this development places a significant strain on individuals and businesses alike. However, these recent changes in subsidy policies may accelerate the adoption of renewable energy systems.

Impact of the Macroeconomic Landscape on the Economic Viability of Technologies

While urban areas struggle with the increasing costs of grid-sourced electricity and alternative backup systems, rural areas face entirely different sets of challenges and opportunities. Predominantly powered by renewables, minigrids are an important electrification strategy for the unconnected rural regions of the country, tapping into Nigeria’s estimated 210 GW of solar photovoltaic and 3.2 GW of wind energy capacity. These electrification projects typically receive funding from the private sector, government, and development organizations. Notable examples include Engie Energy, Cross Boundary, and the World Bank’s 2022 commitment to invest $60 million into solar minigrids, extending electricity access to over 150,000 Nigerians. Additionally, the Distributed Access through Renewable Energy Scale-up (DARES) program receives backing from the African Development Bank. The DARES program extends beyond typical rural electrification efforts by also targeting urban areas, aiming to replace up to 280,000 polluting fossil-fuel generators with renewables. This approach diverges from conventional electrification strategies in many African countries, which often view minigrids as competitors to the main grid that are vulnerable to the main grid’s encroachment. In these settings, minigrids are planned for areas out of reach of the current grid. Nigeria’s broader shift toward adopting solar over fossil-fuel-powered generators is well-aligned with the DARES initiative, especially in grid-connected areas with poor reliability. This transition is partly motivated by the need to mitigate financial strain following the removal of petrol subsidies.

Rather than focusing on distant rural areas to mitigate the risk of their service area overlapping with that of the utility, Nigerian off-grid developers are strategically situating their systems under existing grids to serve urban customers plagued by unreliable power. Known as “undergrid” minigrids, such systems allow minigrid developers to capitalize on higher electricity demand in urban areas, thereby overcoming the challenge of low demand that often hinders off-grid projects in rural areas. Similarly, the Nigerian Rural Electrification Agency’s Energizing Economies Initiative is targeting off-grid electricity solutions to economic clusters that suffer from unreliable grid supply. It is crucial to note that undergrid minigrids may face unique challenges not encountered by the main grid, such as urban equipment power requirements surpassing the minigrid’s capacity. Integrating with the main grid could address this issue.

Three recent studies by the World Bank, RMI, and Power for All highlight the potential for a symbiotic relationship between minigrid and grid systems. For example, minigrids located undergrid could utilize existing grid distribution infrastructure to reduce connection costs. Meanwhile, the main grid could benefit by offloading service to customers who may otherwise be unprofitable to serve directly. These studies point out the need to support regulatory frameworks for successful integration. As previously discussed, provisions in the Electricity Act granting states the authority to regulate and license minigrids could present opportunities for integration to function effectively.

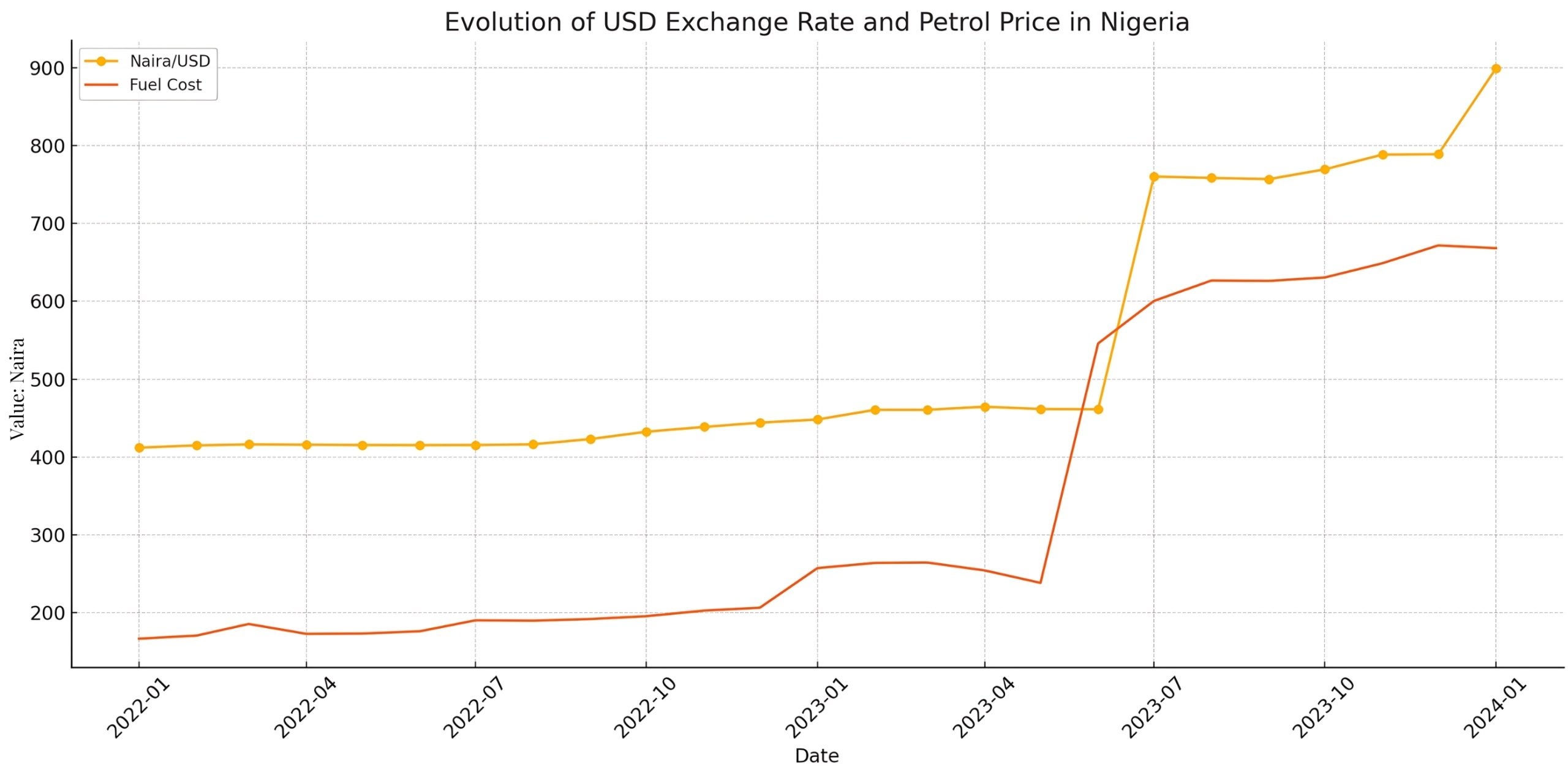

Apart from integrating minigrids, another challenge is determining the most cost-effective generation technology for these backup systems. Due to the declining costs of solar technology versus the increasing and fluctuating prices of petrol and diesel, solar systems have become a competitive alternative to generators. However, studies comparing the cost-effectiveness of solar systems and fossil-fuel-powered generators were conducted prior to recent macroeconomic changes. To guide future solar buildout, businesses and policymakers should reevaluate the relative cost competitiveness of solar and fossil-fuel generators in light of the recent currency depreciation and fuel subsidy removals (Figure 1).

Figure 1: The evolution of the naira/USD exchange rate and the petrol price in Nigeria over time

A Way Forward

The Nigerian government faces immense challenges in securing high-quality, affordable, reliable, and clean power for its citizens. However, these challenges also present opportunities to innovate and transition towards a cleaner, more resilient, and more participatory power system.

Recent shifts in macroeconomic conditions and an increase in off-grid renewable energy systems have created a unique power landscape in Nigeria. Minigrids situated undergrid alleviate grid strain, while rural minigrids provide opportunities for a more decentralized and resilient system. If Nigeria embraces these technologies and empowers states, communities, and private sector groups to deploy and integrate these solutions, it could pioneer a model for future grids, thereby serving as a blueprint for integrating renewables and decarbonizing grids globally.

As the relationship between grid and off-grid systems evolves in Nigeria, regulators and energy project developers must innovate new business models and technological approaches in response to recent macroeconomic and policy changes, along with developing regulatory frameworks to facilitate this grid of the future. The approach Nigeria takes to electrification need not conform to traditional boundaries between grid and off-grid technologies. This less-traveled path will require significant investment and policy innovation. Missteps are sure to occur and provide valuable lessons. But by seizing these opportunities, Nigeria can build a cleaner, more resilient power system that drives future prosperity and serves as a model for countries in Africa and around the world.

. . .

Dr. Nathan Williams is an Assistant Professor at the Golisano Institute for Sustainability at the Rochester Institute of Technology. His research focuses on energy policy and planning in underserved communities, with a particular interest in the use of renewable and decentralized energy technologies to expand access to affordable, sustainable electricity. Dr. Williams’ work focuses geographically on sub-Saharan Africa and Indigenous Nations in the United States. He has a B.S. in Physics and Mathematics from Whitworth University, a M.Sc. in Physics from Nelson Mandela University, and a Ph.D. in Engineering and Public Policy from Carnegie Mellon University.

Tunmise Raji is a doctoral candidate at the Golisano Institute for Sustainability, Rochester Institute of Technology, where his research focuses on leveraging sustainable infrastructure development to catalyze development and growth in the Global South. Before pursuing a Ph.D., Tunmise was a Technical Analyst at Equatorial Power, where he contributed to the development of several island electrification minigrid projects in Uganda and DRC. He has a B.Sc. and an M.Sc. in Electrical Engineering from the University of Ibadan and Carnegie Mellon University, respectively.

Courage Ekoh is a doctoral student at the Golisano Institute for Sustainability at the Rochester Institute of Technology. His research focuses on understanding the barriers to productive electricity use in developing countries in order to provide a more equitable landscape for electricity consumption. Prior to doing a PhD, Courage worked in several positions as a Data Scientist and Machine Learning Engineer in the Fintech and Energy industry.

Image credit: Mikko Jarvenpaa, Unsplash, via Unsplash License

Recommended Articles

This article contends that South Africa’s 2025 G20 presidency presents a critical opening to shape governance of critical mineral supply chains, essential for renewable energy, digital economies, and national…

Germany’s economy is being throttled by a more competitive China that has usurped its previous manufacturing dominance in many industries. In response, Germany has doubled down on the China bet…

In 2021, the European Union (EU) attempted to assert itself in the Indo-Pacific arena to increase its geopolitical relevance by releasing an ambitious and multifaceted Indo-Pacific Strategy. However, findings from…