Title: The Nuclear Gamble: Kazakhstan, Russia, and the Shifting Energy Landscape of Central Asia

In this interview, Anatole Boute, a Professor at the Chinese University of Hong Kong specializing in energy, climate, and investment law, joins Shaimerden Chikanayev, a PhD researcher and international commercial lawyer at the same university, to explore the evolving role of nuclear power in Central Asia’s energy landscape. Mr. Boute addresses Kazakhstan’s energy security challenges, underscoring the importance of balancing energy supply with efficiency and sustainability. Meanwhile, Mr. Chikanayev examines the geopolitical and legal complexities surrounding the country’s nuclear power projects. Together, they delve into Russia’s growing influence in the region through nuclear energy agreements and the potential weaponization of energy dependence—unveiling strategic considerations shaping Central Asia’s energy landscape.

GJIA: Given Kazakhstan’s referendum to move ahead with the development of nuclear power plants and recent agreements made in Uzbekistan, where does nuclear power fit into the broader energy construct of Central Asia?

Anatole Boute: When states decide their energy mix and map the future of their energy systems, they have to balance energy security, affordability, and sustainability. From an energy security perspective, Central Asia faces a critical crisis. For instance, the Kazakh electricity sector suffers from insufficient production capacity and chronic under-investment in its grids. In this context, the additional production capacity offered by nuclear power is welcomed to replace the outdated infrastructure that the region inherited from the Soviet times. However, as I argue in Energy Security Along the New Silk Road, the surge in supply should not distract from the urgent need to implement energy-saving measures on the demand side—especially given the region’s significant potential for efficiency improvements. Central Asian economies are highly energy-intensive and inefficient in energy input per unit of economic output. Improving energy end-use efficiency and modernizing energy systems fortifies the region’s energy stability and contributes to achieving a secure, sustainable, and affordable energy supply in a mutually reinforcing way.

From an affordability perspective, nuclear energy is not a cheap source, and the hefty price tag should be held in contention with that of alternative, clean energy sources, like wind and solar that are now cheaper than traditional methods of electricity production. The central question then becomes how nuclear energy competes with renewables, and at what cost.

From a supply security perspective, Kazakhstan is not just facing an energy deficit but a real lack of maneuverable, i.e. flexible, production capacity. Renewables are mostly variable or intermittent sources, whereas nuclear energy is a base load source. In the path to carbon neutrality, nuclear energy must complement—or compensate for—renewables’ variabilities, which is not evident given that nuclear power is ultimately constrained in operational flexibility.

From a sustainability perspective, nuclear energy is a carbon-neutral source that facilitates the transition away from coal and gas, and thus contributing to climate change mitigation. However, climate change brings its own challenges to the operation of nuclear power plants. Taking into account the importance of a stable water supply to ensure the cooling of nuclear reactors, the Central Asian countries will have to consider future water availability, in a region that is already affected by water scarcity. The situation is only going to be more acute with climate change. In addition, there is a problem with the treatment of radioactive waste.

To summarize, the development of nuclear power in Central Asia presents a number of benefits, but at the same time generates significant questions of affordability, supply security, and sustainability that regional policymakers should carefully consider before committing to this risky trajectory.

Shaimerden Chikanayev: Kazakhstan is currently facing a significant energy deficit, which urgently requires cost-effective and reliable solutions. Despite being part of a region rich in fossil fuels, Central Asia, including Kazakhstan, struggles to meet its energy demands. A key example of this is the natural gas sector. Due to chronic underinvestment in the development of new gas fields, Kazakhstan is unable to satisfy the energy needs of its domestic population and industries, let alone fulfill its contractual obligations to export natural gas to China. Uzbekistan faces a similar challenge, highlighting a regional issue with energy supply.

Given the foreseeable shortage of natural gas as a viable energy source in the near future, nuclear power emerges as a promising solution for both Kazakhstan and Uzbekistan. Unlike wind and solar power, it offers a stable and controllable energy supply that can significantly enhance the country’s energy mix. Kazakhstan’s position as the world’s largest exporter of uranium provides a strategic advantage in developing its nuclear energy capabilities. By leveraging this resource, Kazakhstan can not only address its immediate energy shortages but also will be able to export excess electricity abroad and develop a new nuclear industry.

GJIA: The invasion of Ukraine has deepened Russia’s diplomatic isolation, and the nuclear energy sector—spearheaded by national champions like Rosatom—has become more important to Moscow’s political calculus. How is Rosatom maneuvering its way into a major role in energy projects in Central Asia despite Western hostilities?

SC: Kazakhstan and Central Asia at large are trying not to get trampled by the growth of big powers. The region cannot risk crossing Russia’s or the West’s redlines. Yet, at the same time, we need to pursue our practical goals and protect our interests. The Kazakhstan President needs to tread lightly in declaring Russia the winner of the ongoing tender, as the country certainly does not want to appear to be undermining Western sanctions.

In terms of Russia’s political calculus, Gazprom has lost a lot of force and is now just a shadow of its former self. With sanctions associated with the war in Ukraine dealing another blow to the economy, Russian leadership quickly realized that nuclear power and Rosatom, instead of natural gas and Gazprom, would be their reliable tool of influence moving forward. The Foreign Policy Concept of the Russian Federation, approved by President Vladimir Putin in March 2023, reflects this pivot. This document outlined Russia’s ambition in the so-called “Peaceful Nuclear Diplomacy” and has catapulted the issue to a top foreign policy priority.

In terms of competitive advantages, Russia shares a lot of common history and language with Kazakhstan. The ease of communication breaks down potential institutional and cultural barriers between Kazakh officials and experts who will work on the proposed nuclear power plants and their counterparts in Russia. That is, Russia’s proposal to build a nuclear power plant has a competitive advantage, because for Kazakhstan the transfer of technical knowledge, or even daily communication during the construction of the nuclear power plant, is much easier in Russian than in Chinese or French. On the technological front, Russia is regarded as the global leader in nuclear power plant development, with a proven record in exporting technology to foreign partners and building 19 nuclear power plants so far. In comparison, France only has two reactors abroad; Korea has four; China has just two. Moreover, Russia, unlike other bidders, is seen more as a reliable partner for Central Asian countries in this transition, vouching even to establish local branches of their universities and scholarship programs. The steady supply of cheap money through loan financing, coupled with access to Russian fuel, only sweetened the deal. Lastly, the most significant appeal is Russia’s commitment to help dispose of radioactive waste. Even though nuclear energy from a Kazakh law perspective is clean and renewable, it is strictly speaking not a renewable energy source. Still, the big drawback is that Russia is currently under extensive Western sanctions. This creates perceived risks for the Kazakh government, as reliance on Russian technology and partnerships could expose the country to geopolitical and economic vulnerabilities.

AB: As I argue in Energy Dependence and Supply Security, Russian energy investments in its sphere of influence cannot be explained on commercial grounds only, and thus require geopolitical analysis. From a geopolitical perspective, I see the embeddedness of nuclear power in Russia’s foreign policy goals and the use of bilateral intergovernmental agreements to drive nuclear investments as important elements indicating a geopolitical motive. Another telling characteristic is the use of cheap finance and preferential deals, an approach that Russia also followed in the region’s gas sector. In that construction, Rosatom could then be considered as a geopolitical actor, acting in pursuit of foreign policy objectives, and implementing the obligations and mandates of the Russian government. Geopolitical investments entrench dependencies and can ultimately result in the exercise of strategic influence over the host country.

GJIA: Mr. Chikanayev, given your expertise in international commercial law, what are your insights on Kazakhstan’s legal procedures for selecting a contractor for the construction of a Nuclear Power Plant (NPP) last year? What does it say about the region’s political and legal stability that is pivotal to building and distributing energy from an NPP?

SC: It has now been officially confirmed by the Ministry of Energy of Kazakhstan that so-called negotiations under a process referred to by the Ministry as the “open competitive dialogue procedure” are underway with four shortlisted nuclear technology suppliers for the selection of a contractor to construct Kazakhstan’s first nuclear power plant. However, a critical issue remains: Kazakh law does not provide any legal basis for this so-called “open competitive dialogue procedure.” Strictly speaking, since Kazakh law does not recognize such a procedure, neither the government nor any other entity currently has the legal authority to conduct it. Under current Kazakh legislation, the design, construction, and commissioning of a nuclear power plant must be carried out in accordance with national laws. Therefore, this raises serious concerns about the legality and transparency of the current approach. Such practices lead to perceptions of favoritism, cronyism, or even corruption, further damaging Kazakhstan’s reputation as a reliable destination for investment.

GJIA: Professor Boute, you argued that seeing Russian external energy relations as purely realist is too simplistic of a characterization. From a geopolitical perspective, where does nuclear energy regulation come in as a tool of strategic influence for Russia? Who are Russia’s biggest competitors and what does the country stand to gain from its nuclear cooperation in the post-Soviet Eurasian space?

AB: To have more clarity on Russia’s nuclear playbook, it might be helpful to compare similar approaches in Russia’s gas policy and the geopolitics of those infrastructure investments. Russia makes use of energy supply and infrastructure investments, often at preferential conditions, to secure control over its sphere of influence. These investments are governed by bilateral intergovernmental agreements that impose far-reaching constraints on the host country’s government, e.g. prohibiting them from engaging in energy market reforms or diversifying their energy imports, thus reinforcing dependencies on Russia and exposing Russia’s partners to the future threat of weaponization of these dependencies.

This strategy is not specific to gas supply but can also be identified in the electricity production sector, including nuclear power plants. At first glance, energy infrastructure investments are commercial projects made by Russian enterprises. In reality, they are often driven by geopolitics in a highly strategic context. Cheap finance, a clearly identified foreign policy objective, the use of intergovernmental agreements, the involvement of state-owned enterprises, and the strategic importance of the host state government are indicators of this geopolitical consideration.

GJIA: What do Central Asian countries gain on the other end? What are some of the hard dependencies that these host countries are at risk of? What can Central Asian countries do to minimize Russia’s weaponization capacity where energy becomes a tool of coercion and political leverage?

AB: The most obvious gain is the increase in supply from the additional production capacity. Demand adequacy is a crucial component of a secure electricity supply. At the same time, there is a risk that these investments could reduce the pressure on governments to reform energy markets, improve efficiency, and promote alternative renewable energy sources. The emphasis on efficiency is necessary; simply focusing on adding more supply through geopolitical deals risks creating dangerous dependencies and perpetuating a cycle of inefficiency that continuously demands more supplies and slows the progress to reform.

From a fuel supply security perspective, Uzbekistan and Kazakhstan are important miners and exporters of uranium, which explains their interest in the development of nuclear power as part of their energy mix in the electricity sector. Yet, the same uranium needs to go through a conversion and enrichment process before the fuel can be used in the production process. Although rich in natural resources, Uzbekistan and Kazakhstan are likely to remain dependent on Russia for enriched uranium.

There is also an opportunity cost to the uranium supply security argument. As the West tries to reduce its dependency on Russian energy, Kazakhstan and Uzbekistan are strategically positioned to help address the resulting scarcity in the uranium market. By using uranium domestically to fuel nuclear power plants, they lose the opportunity to export it to international markets. This is the same with the gas supply market, where Uzbekistan is an important consumer of its own gas, gas that could otherwise be exported to the international market to generate hard currency. Part of the calculus is also the cost of clean energy, which has now become the cheapest source of electricity—cheaper than coal in many jurisdictions. Uzbekistan is a significant importer of Chinese solar PV equipment and could continue to benefit from this commercial cooperation to decarbonize its electricity supply at the least cost.

Furthermore, the high cost of nuclear power plants may create financial dependencies, e.g. in terms of repayment, and these investments may generate technological and operational dependencies. In case of geopolitical tensions, these technical and operational dependencies could complicate the nationalization of nuclear power plants. As illustrated by the case of Ukraine’s Zaporizhzhia plant, nuclear power presents serious security and safety concerns in case of geopolitical or military conflict.

To mitigate these risks, it is important to engage in market reforms, implement energy efficiency improvements, diversify the energy mix, and accelerate the deployment of renewables like solar and wind.

SC: Kazakhstan and other countries of Central Asia must ensure that all major infrastructure projects, including the construction of nuclear power plants, are conducted within the framework of transparent and universally applicable national laws, such as the Public Procurement Law or Public-Private Partnership Law. This would not only help restore confidence in Kazakhstan’s national legal system but also mitigate the significant political risks associated with the selection of a contractor for a nuclear power project. In the current geopolitical climate, where partnerships with entities like Rosatom may be viewed as politically sensitive or even unacceptable by Western counterparts, a transparent and legally grounded tender process is essential to ensure that the selection is based on technical and economic merits rather than geopolitical considerations. Such an approach shall ensure that the proposed nuclear power projects will be sustainable in the long run and beneficial to the local population.

. . .

Anatole Boute is a Professor at the Faculty of Law at the Chinese University of Hong Kong, specializing in energy, climate, and investment law. He is the author of “Energy Dependence and Supply Security” (2023), “Energy Security Along the New Silk Road” (2019), and “Russian Electricity and Energy Investment Law” (2015). His research focuses on the legal aspects of the transition of energy systems towards sustainability, with a special interest in energy market reforms in emerging economies. Anatole Boute is admitted to the Brussels Bar (Belgium) and regularly assists multilateral development banks, national agencies, and investors on energy and climate regulation.

Shaimerden Chikanayev is a PhD student at the Chinese University of Hong Kong and a partner of GRATA International Law Firm. Shaimerden has over 15 years of experience working on energy and infrastructure projects, public-private partnerships, and cross-border transactions across Central Asia and post-Soviet Eurasia.

This transcript has been lightly edited for clarity and length.

Interview conducted by Sharon Xie.

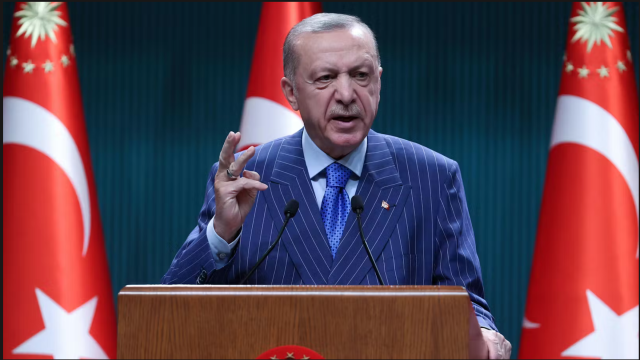

Image Credit: Sergbeer at Russian Wikipedia, CC BY-SA 3.0, via Wikimedia Commons

Recent Interviews

In 1953, Kuwait established the world’s first sovereign wealth fund to invest the country’s oil revenues and generate returns that would reduce its reliance on a single resource. Since…

Cruises have increasingly become a popular choice for families and solo travelers, with companies like Royal Caribbean International introducing “super-sized” ships with capacity for over seven thousand…

In March 2025, widespread protests erupted across Türkiye following the controversial arrest of former Istanbul Mayor Ekrem İmamoğlu, an action widely condemned as politically motivated and…